As Bayraktar Attorneys, we continue our mission to provide businesses with valuable insights into the tax landscape of Turkey. This time, we explore the advantages that companies enjoy when operating in Turkish Free Trade Zones.

These zones offer numerous exemptions, making them highly attractive destinations for businesses seeking to expand their operations in the country. Let’s dive into the key tax benefits that companies can leverage in Free Trade Zones:

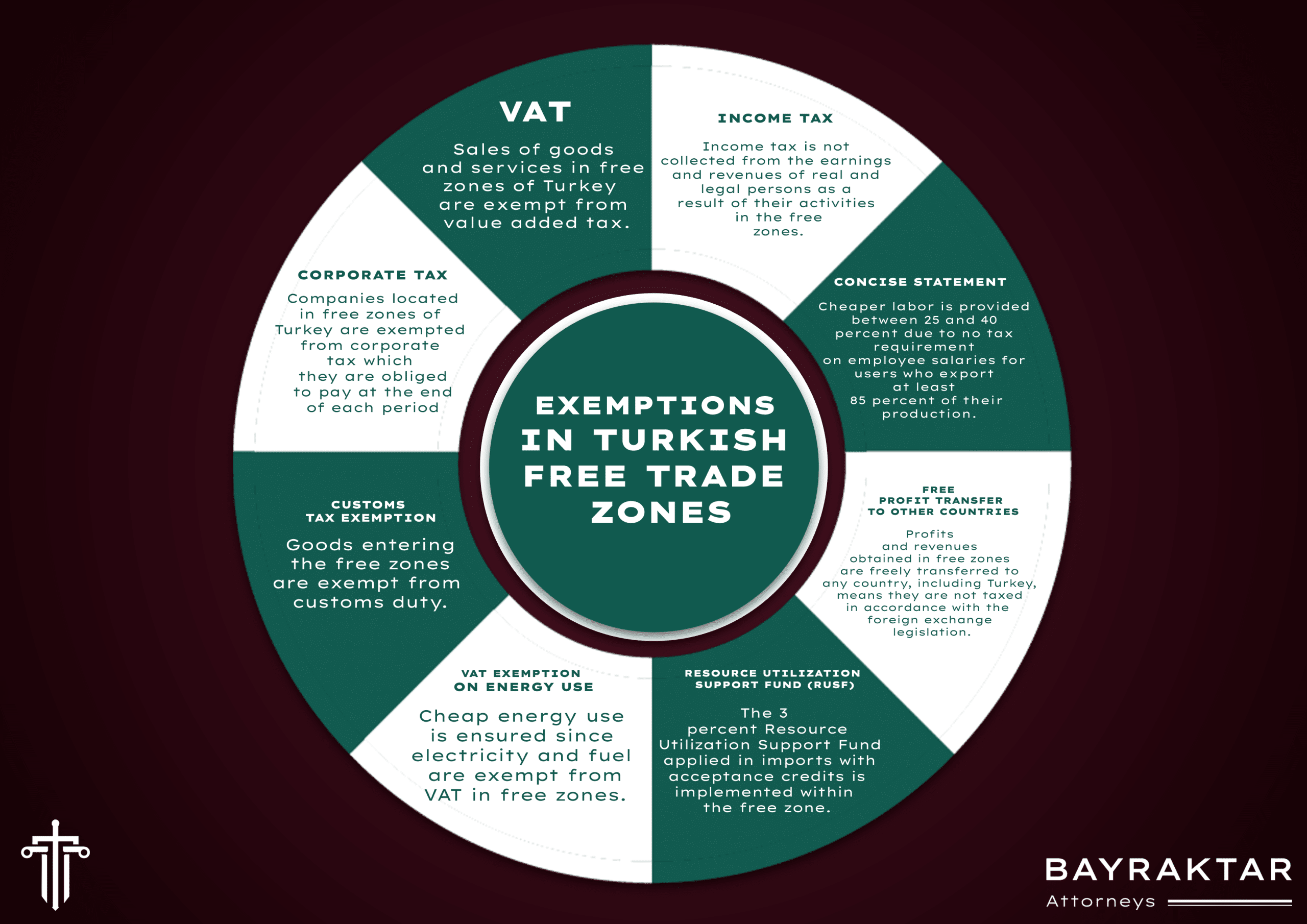

Tax Exemptions In Turkish Free Trade Zones

Let’s talk in detail about the benefits businesses will get in terms of taxes when dealing in free trade zones:

- Corporate Tax Exemption: One of the most significant advantages for companies operating in Free Trade Zones is the exemption from corporate tax. This means that businesses located in these zones are relieved from paying the standard corporate tax at the end of each financial period, offering substantial cost savings and promoting investment.

- VAT Exemption: Sales of goods and services within Free Trade Zones are exempt from Value Added Tax (VAT). This exemption significantly reduces the overall tax burden for businesses, making the zones an attractive choice for conducting various commercial activities.

- Income Tax Exemption: Income tax is not levied on the earnings and revenues of both individuals and companies as a result of their activities within Free Trade Zones. This tax exemption encourages businesses to explore growth opportunities within these zones, fostering a vibrant and dynamic business environment.

- Concise Statement (Tax Exemption on Employee Salaries): Companies in Free Trade Zones enjoy a unique advantage when it comes to employee salaries. For businesses that export at least 85% of their production, there is no tax requirement on employee salaries. This results in a significant cost reduction of between 25% to 40%, making Free Trade Zones an ideal choice for accessing cost-effective labor.

- Customs Tax Exemption: Goods entering Free Trade Zones are exempt from customs duties. This exemption streamlines import and export processes, reducing administrative burdens and facilitating seamless cross-border trade.

- VAT Exemption on Energy Use: In Free Trade Zones, businesses benefit from a VAT exemption on electricity and fuel, ensuring cheap energy usage. This advantage is instrumental in reducing operational costs and enhancing competitiveness.

- Resource Utilization Support Fund (RUSF): The 3% Resource Utilization Support Fund (RUSF) applied on imports with acceptance credits is implemented within the Free Trade Zones. This enables businesses to efficiently manage their financial resources, contributing to their overall profitability.

- Free Profit Transfer to Other Countries: Perhaps one of the most attractive benefits, profits and revenues earned within Free Trade Zones can be freely transferred to any country, including Turkey. This means that these profits are not subject to taxation according to foreign exchange legislation, offering flexibility and ease of doing business on an international scale.

In conclusion, Free Trade Zones in Turkey present a plethora of tax exemptions and incentives that make them a compelling choice for businesses seeking growth opportunities.

At Bayraktar Attorneys, we are well-versed in the regulations and complexities surrounding Free Trade Zones and are here to guide businesses through establishing and operating within these zones.

For any legal assistance or inquiries, please feel free to contact us. Together, we can unlock the full potential of your business in the dynamic Turkish market.

Recently Added Blogs

.png)

.png)

.png)

.png)