A potential Tax Identification Number is a unique number issued by the Government Tax Office. While ‘Tax Number’ is used by citizens to pay taxes, ‘Potential Tax ID Number’ is a form of temporary ID number for foreigners who want to engage in official authority transactions in Turkey without a Turkish Resident Permit or Citizenship.

Why would you need a Tax ID in Turkey?

Possible transactions using a Potential Tax ID number include:

How To Get A Tax Number In Turkey As A Foreigner?

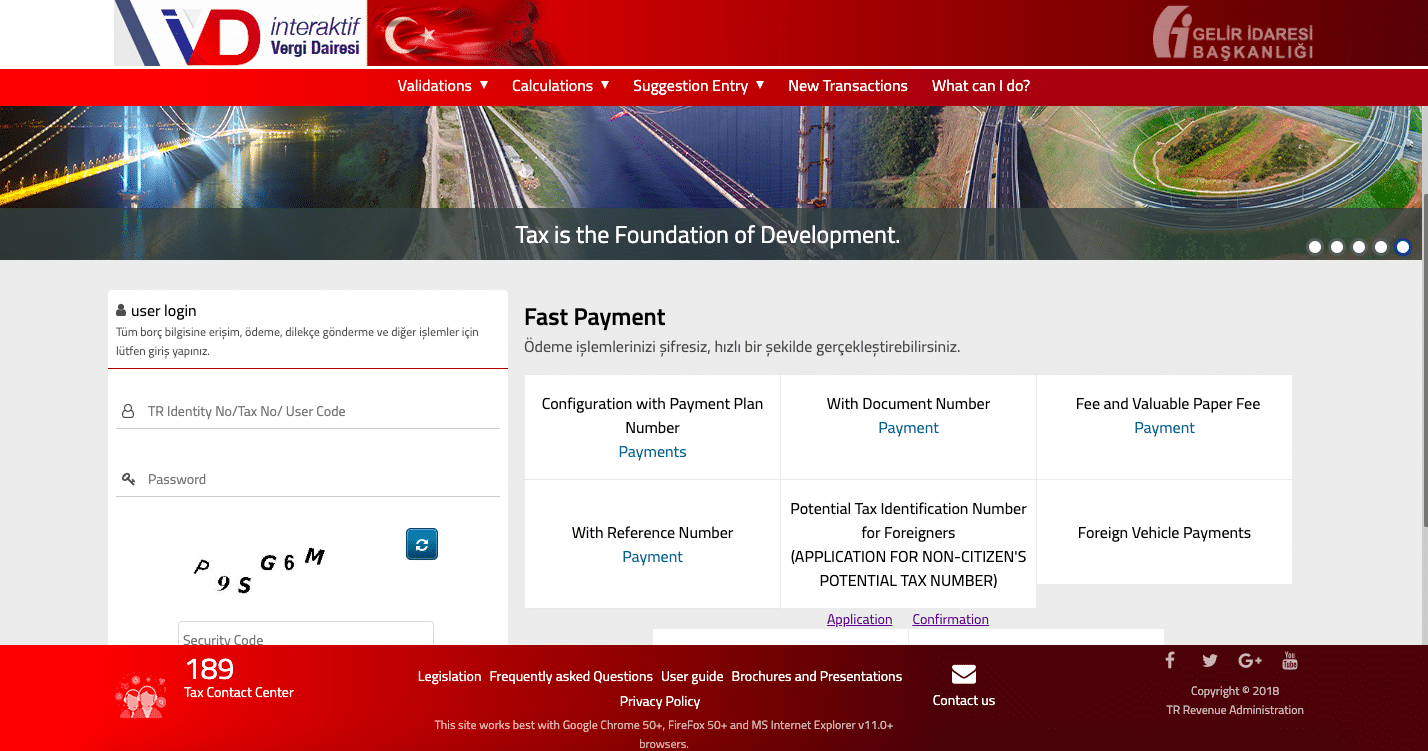

If the applicant has already visited Turkey with the passport used to apply for a Potential Tax ID Number, they may receive a Possible Tax ID Number online via the Government Tax Authority’s website.

If the applicant has never traveled to Turkey or has entered Turkey with a different/previous passport, the Government Tax Offices may issue a Potential Tax ID number.

On behalf of their client, foreign legal representatives/attorneys can get a Potential Tax ID Number via Power of Attorney online or in the Government Tax Office.

Benefits of having a Tax ID in Turkey

Having a Tax ID (Vergi Kimlik Numarası) in Turkey offers several benefits, especially for residents and foreigners engaging in financial, legal, and administrative activities.

Here are the key advantages:

Don’t miss out on the opportunity to conduct official transactions in Turkey! If you’re a foreigner without a Turkish Resident Permit or Citizenship, you can still obtain a Potential Tax Identification Number to conduct business and engage in official transactions. At Bayraktar Attorneys, our team of experienced lawyers can assist you in obtaining a Potential Tax ID Number quickly and efficiently, allowing you to conduct the transactions you need to make. Contact us today to learn more about how we can help you obtain your Potential Tax ID Number and make your time in Turkey as productive as possible.